You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 26 August 2021 | ESG

It’s clear that different things matter to different people. And that’s particularly true for environmental, social or governance (ESG) investment strategies. Our research demonstrates that there are certain industries people believe should never be included in an ESG fund.

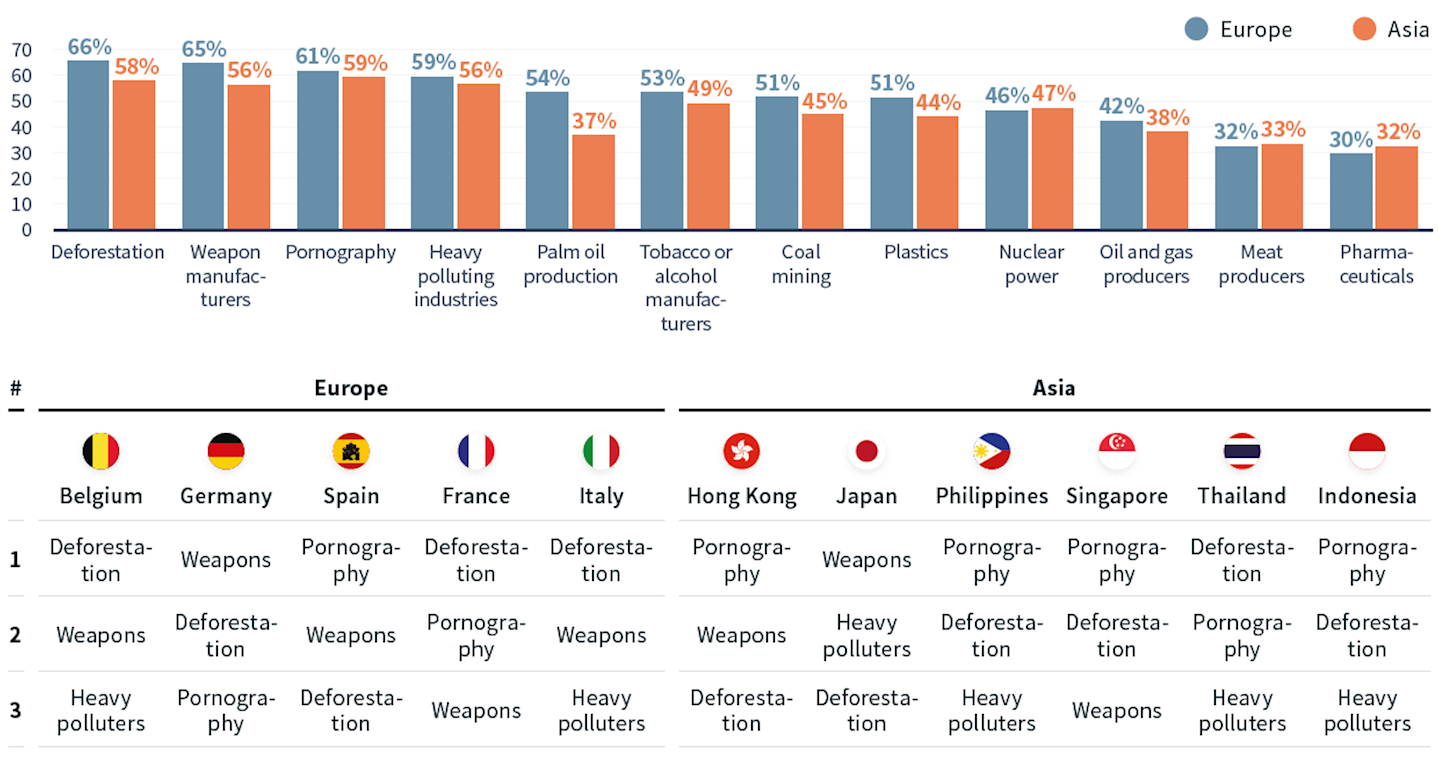

Let’s first take a look at the headlines of our research. Deforestation, weapons manufacturing and pornography are the top three sectors that investors didn’t want included in an ESG portfolio. This is the case across Europe and Asia. Indeed, there is a startling similarity in views across continents and at an individual country level.

To what extent do you feel that ESG investment funds should NEVER invest in a company in the following sectors? % Agree (All respondents)

Although, as you dig deeper, things are not always that straightforward. Take deforestation – while it is mentioned as a top three response in each country as unacceptable in an ESG fund, a significant minority (34% in Europe and 42% in Asia) do not highlight it at all. This is particularly the case in Asia, which may in part reflect the developing nature of some of these economies, where the economic and labour force benefits of deforestation may be a bigger consideration.

It is on the issue of palm oil production that differences in views between European and Asian markets is the largest. With Indonesia (along with Malaysia) dominating global production of palm oil, these differences are perhaps to be expected. However, they underline that perceived acceptability can vary widely issue by issue.

Beyond this, we must be cautious about sweeping generalisations. Nuance does not lend itself to simple and transparent communications, but nuance and circumstance play a key role in how funds are structured. This is particularly the case as we look to support the transition to a low-carbon economy, where efforts also need to be spent supporting companies to improve their ESG shortcomings. Raising the question, should it not be the role of an ESG fund to help implement that change?

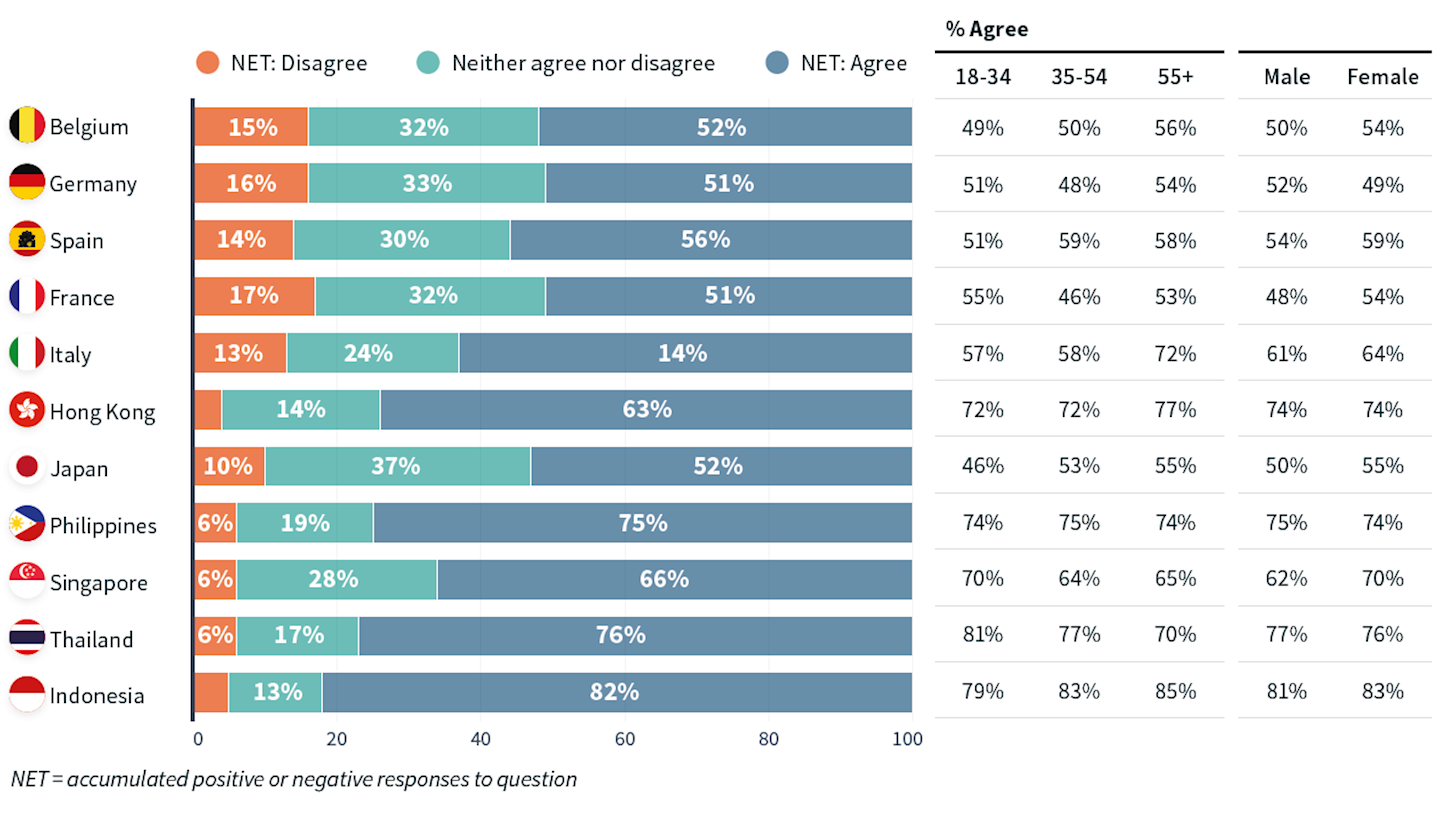

Investors typically believe that ESG fund managers should work with companies to bring about this change – particularly across Asian markets. European investors generally seem more conflicted.

Bringing this to life, two-fifths of people believe that oil and gas providers should never be included within an ESG fund. While a small minority (reaching 17% in France) disagrees an oil or gas company investing in renewable technologies to transition to a low-carbon future could be included in an ESG fund. Two very different findings to what is basically a different take on the same question.

While there is no right or wrong answer here, the key point to take away is that opinions are not necessarily as fixed as people think they are. But this can cause a headache for those building future ESG funds for investors. An initial reaction to a company being included within the fund can be very different to a more informed and considered reaction. The challenge, therefore, is in how we bring investors along on that journey of understanding when it is unlikely that they will go on that journey alone.

To what extent do you agree that an Oil, Gas or Mining company investing in renewable technologies to transition a carbon-free future could be included within an ESG fund that you invest in? (Investors only)

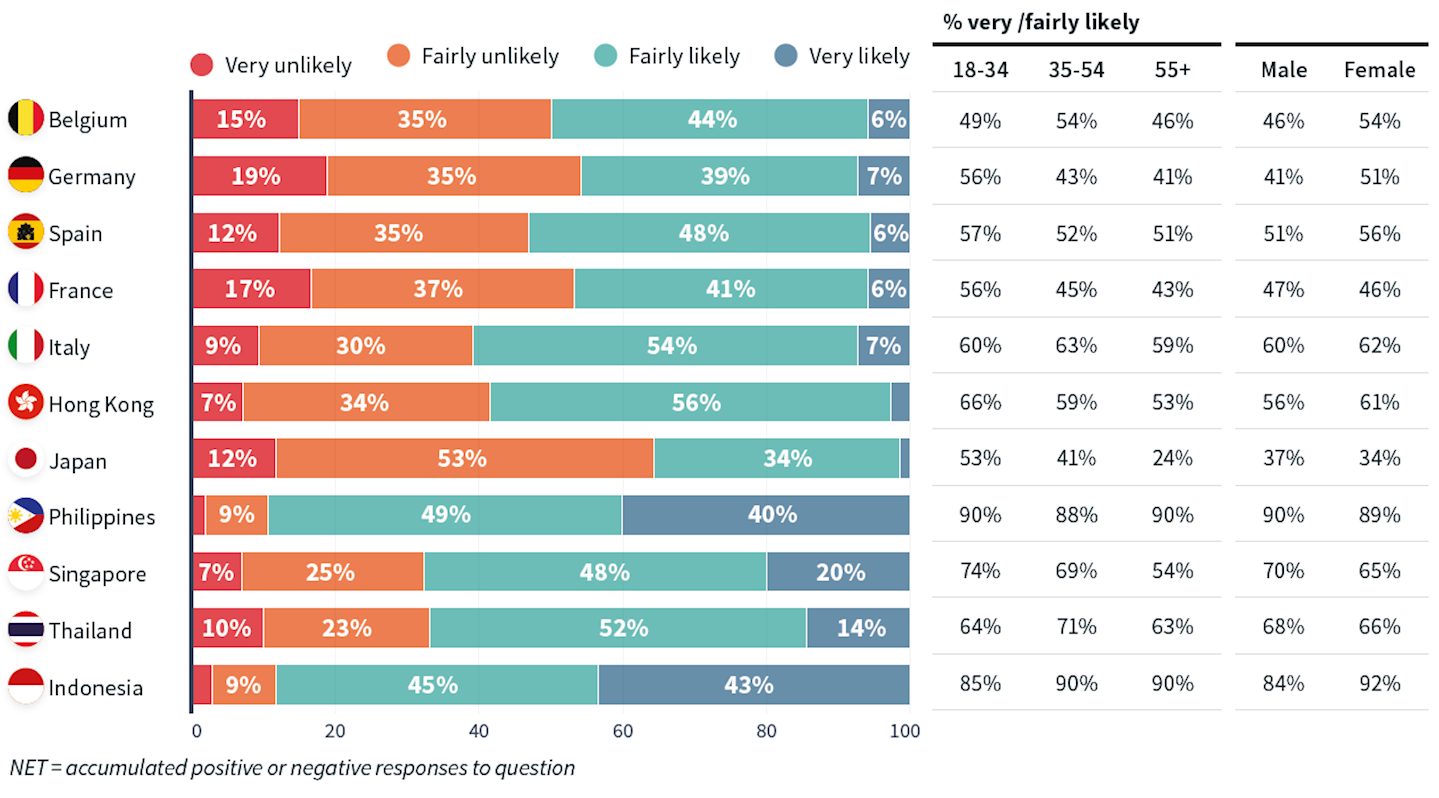

Portfolio construction, though, is of course only one element of a product build. How it is positioned in terms of fees is critical – particularly when we consider the possible additional work involved in researching, building, maintaining and reporting on an ESG fund.

The good news is that investor sentiment to the likely performance of an ESG fund is largely positive, with investors far more likely to feel funds would outperform non-ESG funds of a same risk level than underperform. And investors are more willing to pay more for better performing funds. This is something we see reflected in attitudes towards fees. In European markets, around half of investors are at least fairly likely to pay more for ESG funds – as high as 61% in Italy. Across Asia, there is generally a greater willingness to pay more, with Japan the only exception, where only 35% held this view.

How likely is it that you would be willing to pay more in fees to invest in an ESG fund that aims to combine positive investment returns whilst promoting the ethical management of businesses and positive impacts on society and the environment? (Investors only)

What does this mean for the future of ESG? That remains to be seen, but we may observe two directions of travel. The first being less research-intensive products that adopt generally cheaper exclusion strategies. And the second, involving greater active investment with companies and a focus on less visible ESG risks that require specialist knowledge.

With the growth of ESG passives, there is now more fee competition than ever before. The danger is that the ESG approach could become watered down to the point that it no longer truly achieves the aims of an ESG fund. Ultimately, such an outcome would be a complete failure in the industry to develop truly consumer-centric ESG funds.

If you would like to see the full results from our study, they can be found here